Accounting Payroll Register Worksheet Answers

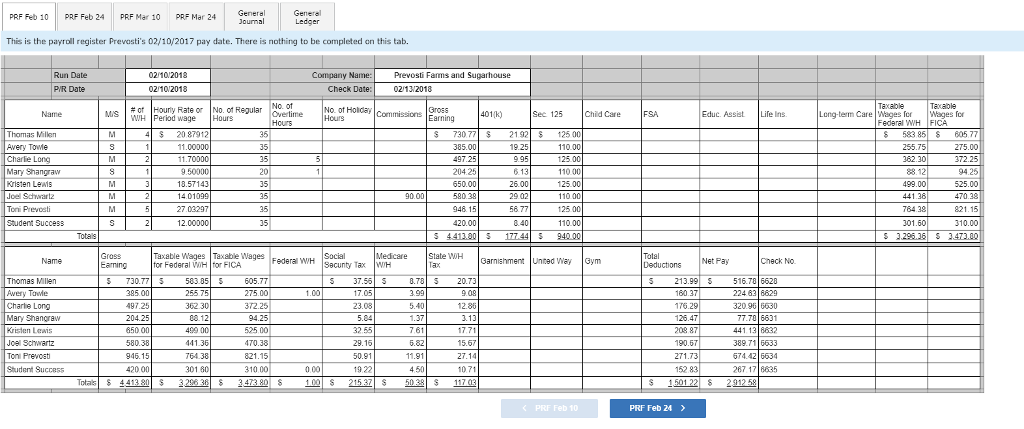

It displays pay date employee id name wage rate per hour the number of hours worked tax deductions insurance deductions and net payment payable. Discover learning games guided lessons and other interactive activities for children.

Payroll Accounting 2019 Bieg Toland 29th Edition Chegg Com

The first sheet is used to record and keep the track of all important individual employee information.

Accounting payroll register worksheet answers. While the second is your payroll register and keeps track of all payroll information. This payroll register template is built in excel format which mentions payroll details of the employees by pay date wise. The register is sorted by pay date and employee id.

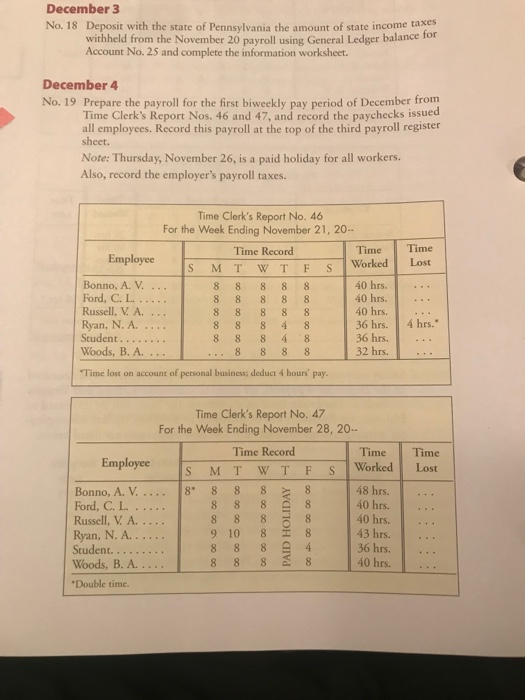

ANALYSIS Identify Classify Business Transaction Section 1 Journalizing and Posting the Payroll 341 3338-371_CH13_868829indd 34138-371_CH13_868829indd 341 991505 12639 PM1505 12639 PM. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. List the data needed to.

There are two sheets in the Excel workbook. A great spreadsheet for keeping track of your employees payroll. His regular wage is 12hour.

The article explains how to use the Excel 2003 List feature and AutoFilter feature to get customized totals from this payroll register. ACCOUNTING 103 - Spring 2016. The objectives covered include.

A payroll register in excel is a simple Microsoft excel spreadsheet which is used to keep track of the weekly bi-weekly or monthly payments to employees. 10 excel spreadsheet for payroll. Week 4 Assignment - Payroll Project.

Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Michael works 46 hours of which 6 hours were overtime. When ABC Company issues Mary her payroll check for the most recent accounting period they would post the following entry to decrease debit the Wage payable account balance and payroll tax balance and decrease credit cashIn accounting software such as QuickBooksyou will credit the bank account you are paying your employee from2 Payroll Journal Entry For Salary Payable.

Excel files are called workbooks. Week 4 Assignment - Payroll Project. 1 SPREADSHEET ACCOUNTING I P10 PAYROLL REGISTER PR INTRODUCTION This problem develops an automated and reusable payroll register that will calculate the deductions and net pay take-home pay for various gross pay amounts.

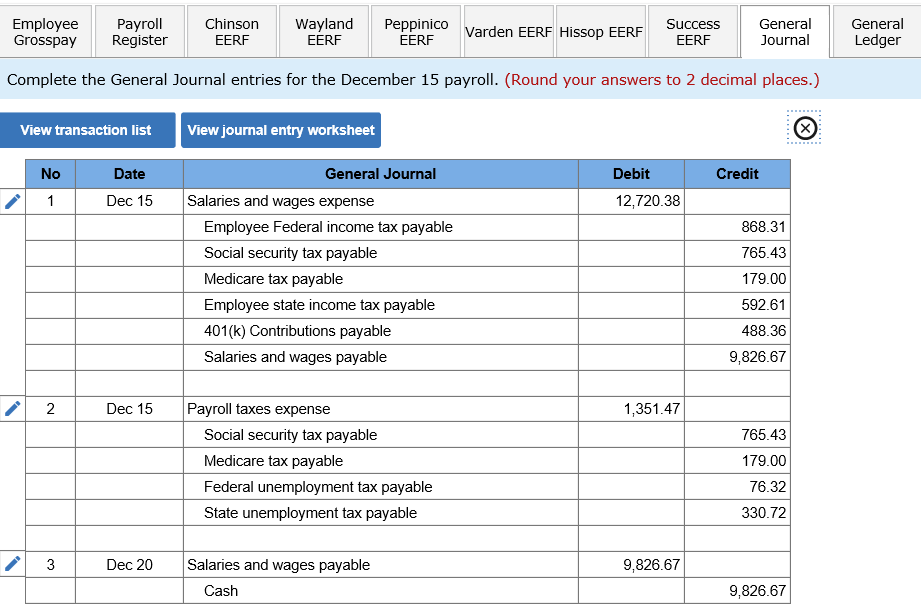

Overtime is paid at 15 that rate. The first is used to keep track of all important individual employee information. The journal general ledger payroll register and employees earnings records.

Learn vocabulary terms and more with flashcards games and other study tools. You need reading your letter so that it may be good to set the thoughts into some sort of arrangement thats simple to follow along 32 to be as easy as possible. Read to Learn the two main functions of a payroll system.

Chapter 5 Populations Test Answers Discover the key to improve the lifestyle by. Discover learning games guided lessons and other interactive activities for children. Among the very first things you can do in order to help to.

When completing the Personal Allowances Worksheet 1 is always added to the total if the employees tax return filing status is _____. If his tax tax rate is 15 percent. This sample payroll register template will help you follow along with the examples in the article.

Work Sheet - 10 Column Work Sheet. Track employee payroll information payments hours and more. We have covered Worksheet topic in great detail.

Each worksheet is made up of rows and columns. Week 3 Assignment - Income Tax Withholding. The workbook for this project has 4 worksheets.

Accounting Worksheet Problems and Solutions. 310 the different methods of computing gross pay. All payroll systems have certain tasks in common as shown in Figure 121.

Main Idea Gross earnings is the total amount an employee earns in a pay period. Prentice Hall Biology Chapter 12 Worksheets Answers Discover the key MidwayUSA is a privately held American retailer of various hunting and outdoor-related productsDownload zip of my accounting lab answers. Roadrunners payroll register in Figure 125 on page 320 is the source document for the payroll journal entry.

Now it is the right time to do practice and get good marks in the exam. Practice is the key to success in Accounting paper exams. Chapter 7 Payroll Project Answers.

The excel IF function is the feature that will be used to accommodate the different conditions when calculating the Social Security taxes. Accounting Worksheet Problems and Solutions. Submits payroll reports and pays payroll taxes.

A single workbook can store many worksheets and are stored like pages in a notebook. Start studying Payroll Accounting. The columns in the payroll register CANNOT be modified.

Learn more about payroll records by completing the lesson titled Completing Departmental Payroll Records in Accounting. There are two sheets in the Excel workbook. Such models are of different types including the employee payroll register company payroll register HR payroll register accounting payroll register.

A business letter has to be impeccable as much as spelling and grammar is concerned. The company cannot give the payroll register template to individual employees unlike the pay stubs because it holds confidential information.

Wayland Custom Woodworking Payroll Project Are These Chegg Com

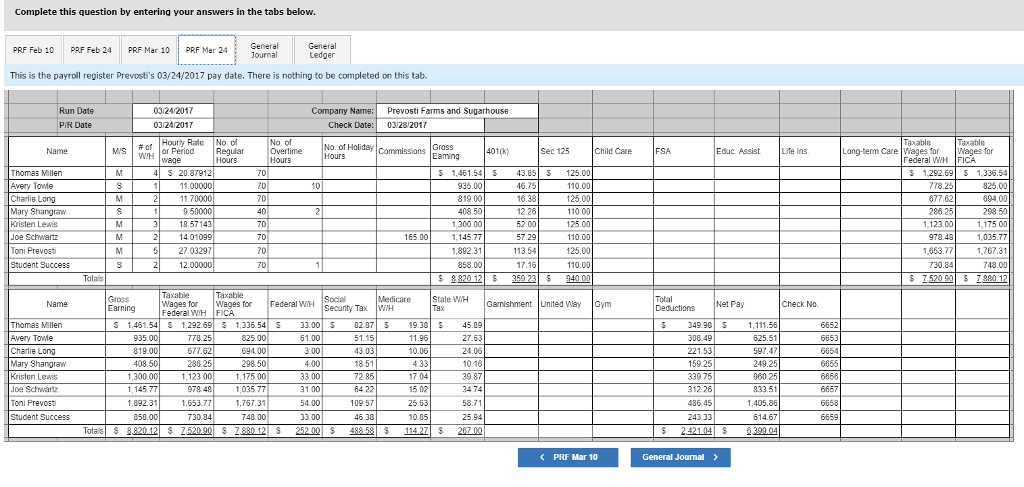

Payroll Register For The Prevosti Farms And Chegg Com

Completing A Payroll Register Pdf Free Download

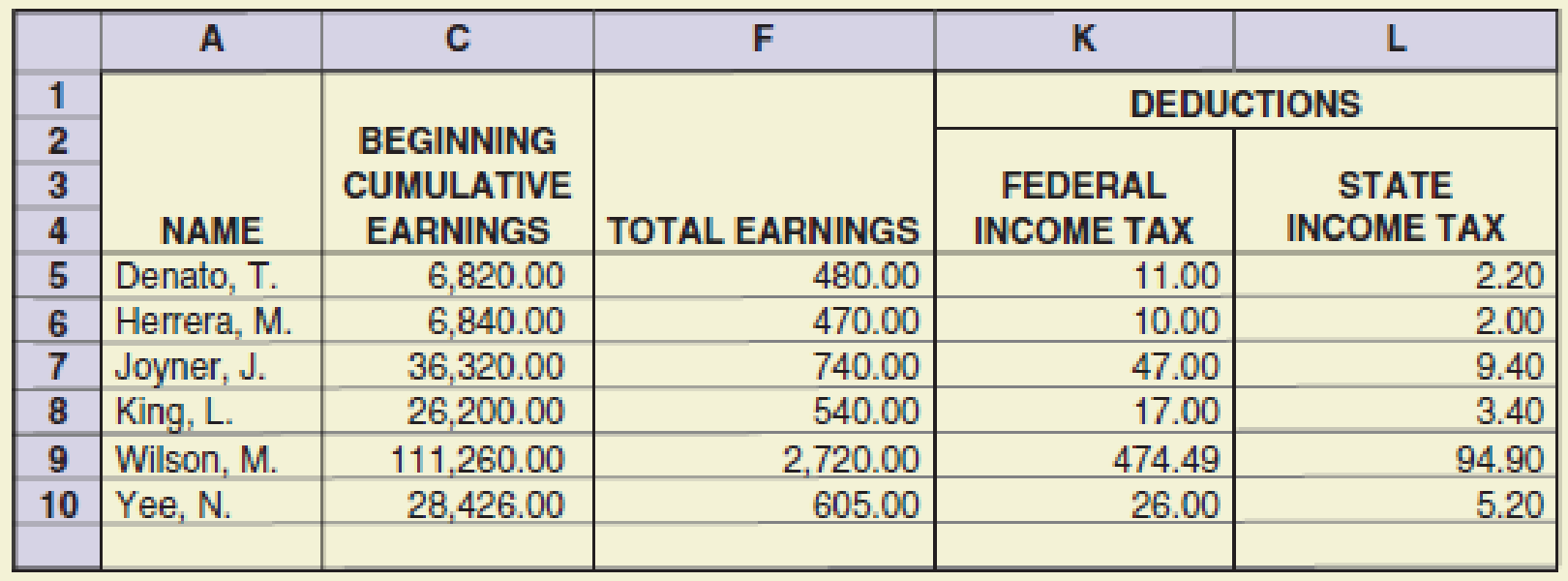

Problem 12 9 Preparing The Payroll Register Showbiz Video Has Six Employees Who Are Paid Weekly The Hourly Employees Are Paid Overtime For Hours Course Hero

3 Exercise 9 19a Preparing Payroll Register And Chegg Com

Completing A Payroll Register Pdf Free Download

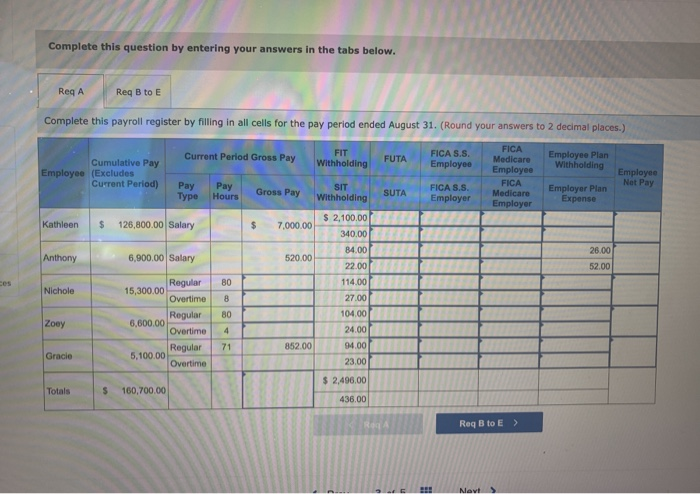

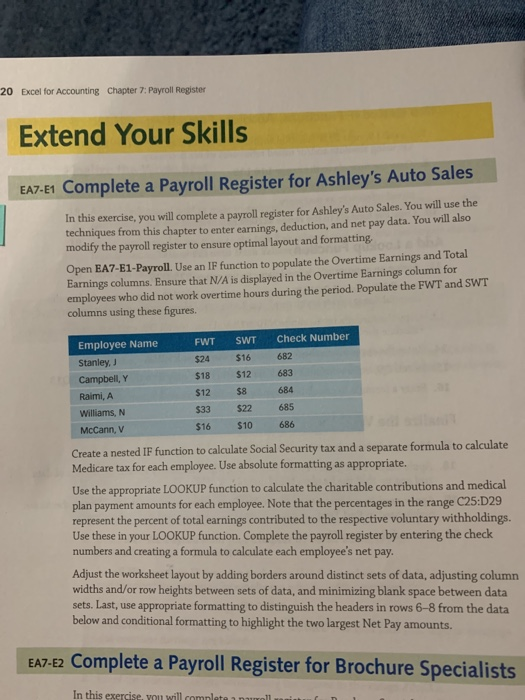

20 Excel For Accounting Chapter 7 Payroll Register Chegg Com

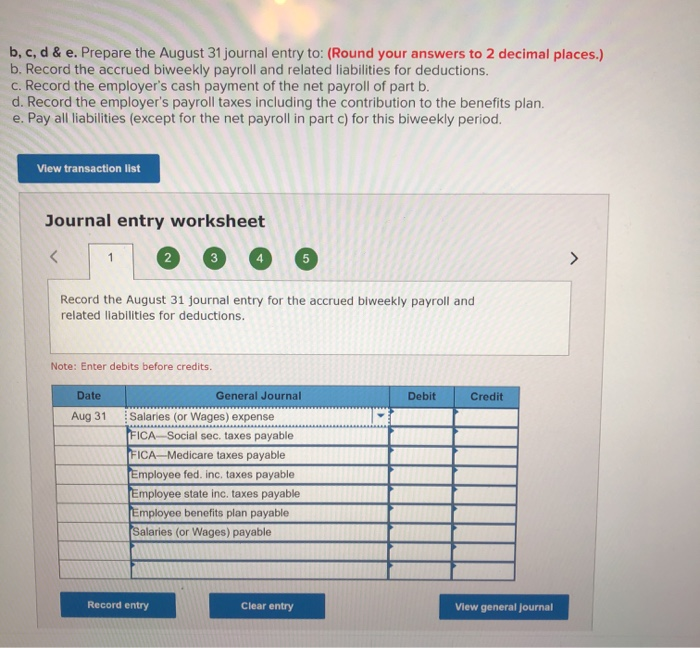

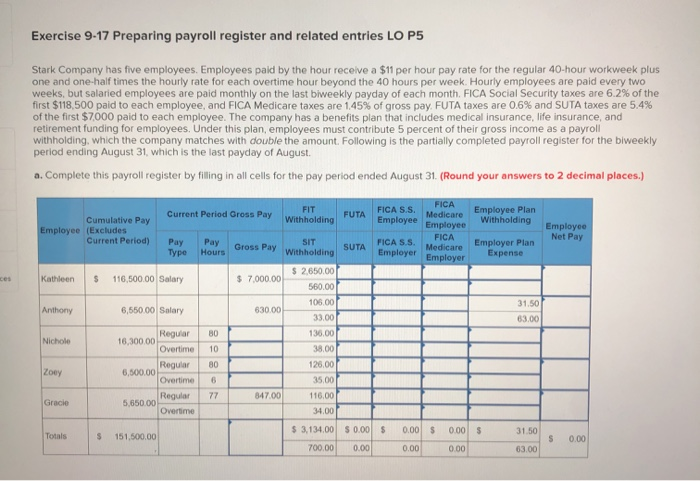

Exercise 9 17 Preparing Payroll Register And Related Chegg Com

Https Robisoncte Edublogs Org Files 2014 06 13 Accounting Text 1n1190o Pdf

Completing A Payroll Register Pdf Free Download

Exercise 9 17 Preparing Payroll Register And Related Chegg Com

Payroll Register For The Prevosti Farms And Chegg Com

Solved Ea7 A1 Create A Payroll Register For Athletics Supply House In This Exercise You Will Create A Payroll Register For Athletics Supply House Course Hero

Completing A Payroll Register Pdf Free Download

Complete Accounting Services Has The Following Payroll Information For The Week Ended December 7 State Income Tax Is Computed As 20 Percent Of Federal Income Tax Assumed Tax Rates Are As Follows

Chapter 12 Completing A Payroll Register And Employee Earnings Record Youtube

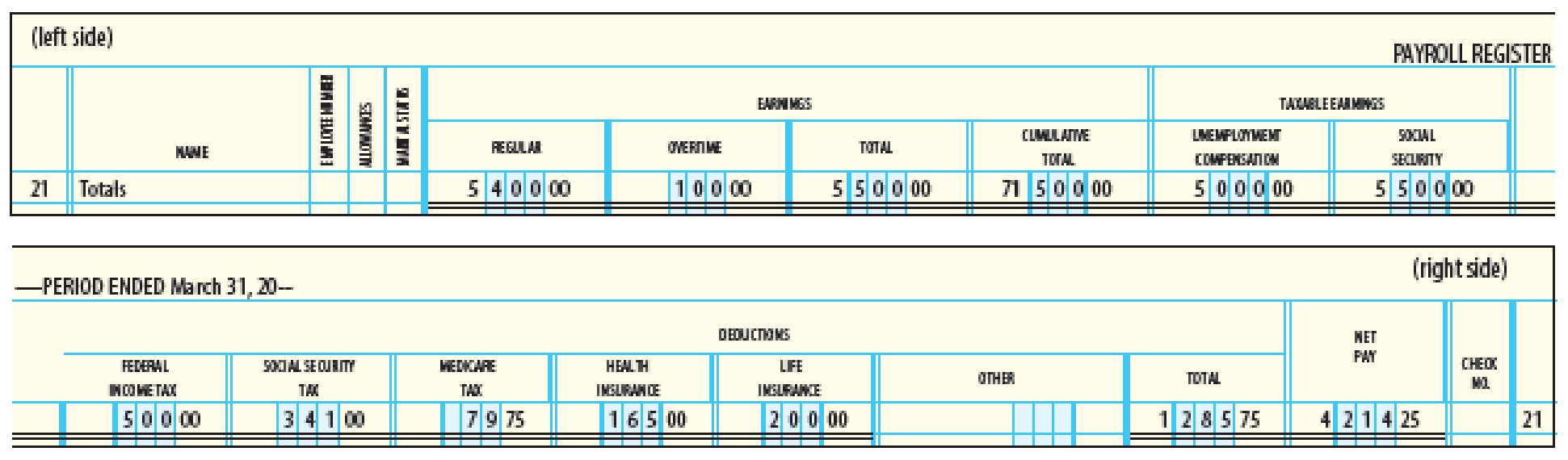

The Totals Line From Nix Company S Payroll Register For The Week Ended March 31 20 Is As Follows Payroll Taxes Are Imposed As Follows Social Security Tax 6 2 Medicare Tax 1 45 Futa