Filling In The General Journal After The Worksheet In Accounting

Thats why it is also called the original book of entries or chronological book or day book. Journal or General Journal.

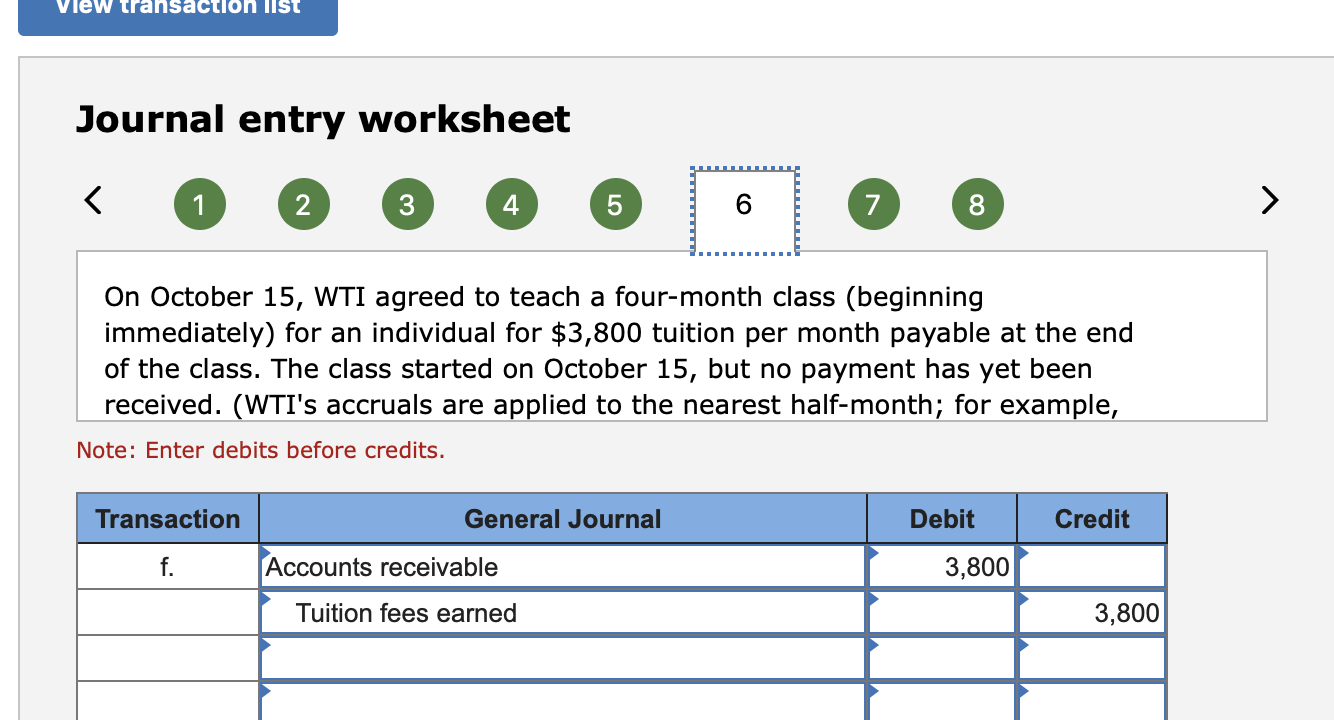

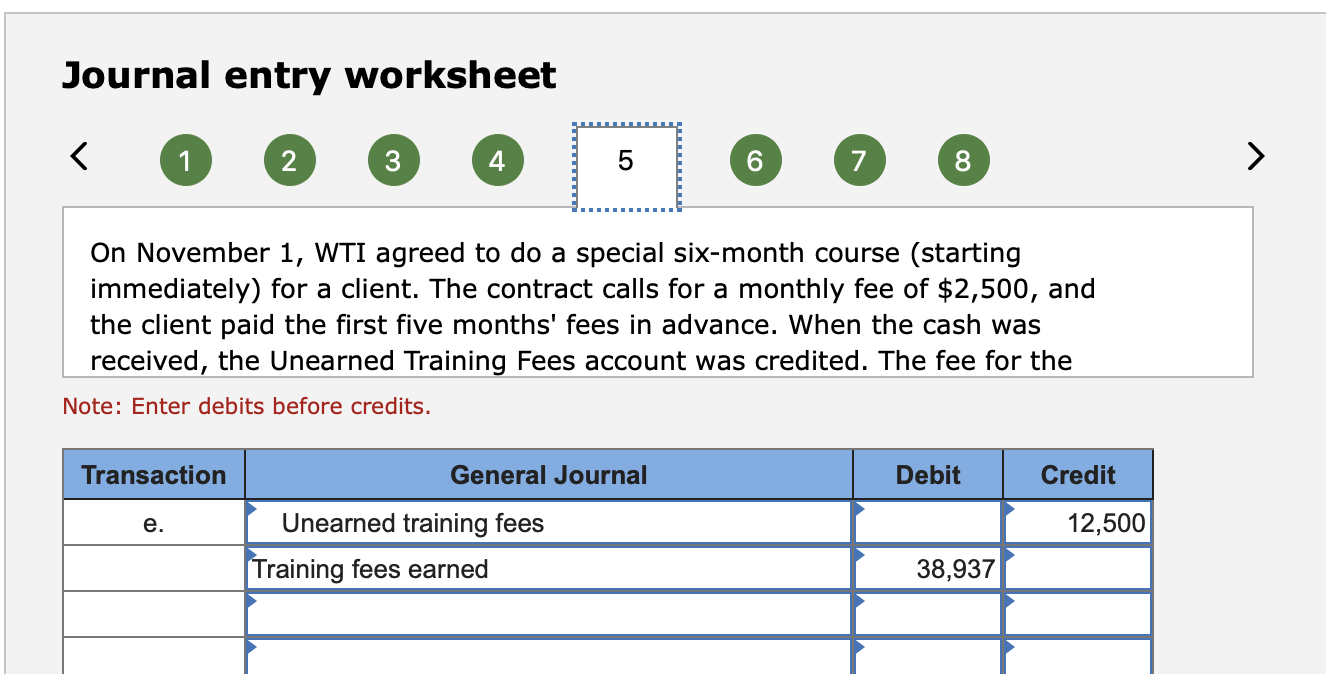

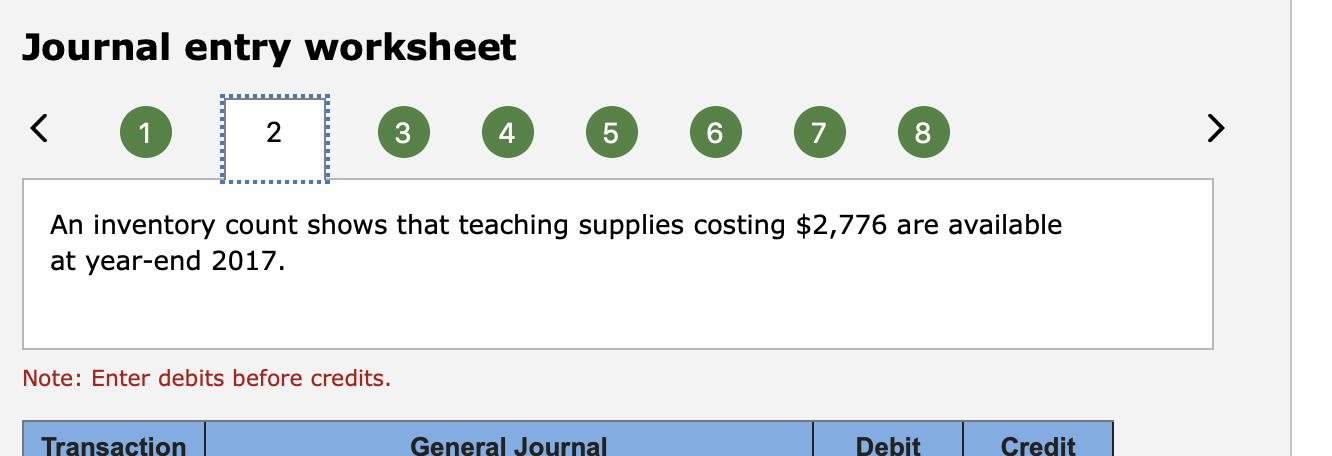

Journal Entry Worksheet 02 C C C C C C C An Chegg Com

Ad Download over 20000 K-8 worksheets covering math reading social studies and more.

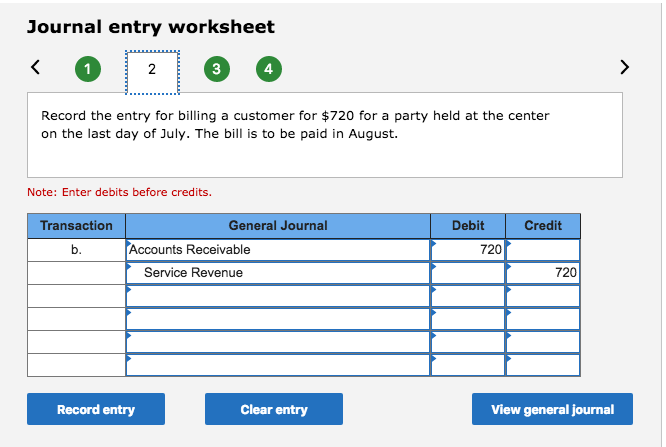

Filling in the general journal after the worksheet in accounting. As business events occur throughout the accounting period journal entries are recorded in the general journal to show how the event changed in the accounting equation. Record in a general journal transactions to set up a business. For instance if you are preparing a journal to be.

Record in a general journal transactions to buy insurance for cash and supplies on account. Will also continue using the general journal and general ledger to journalize and post the new adjusting entries introduced in the chapter. The chapter explains various adjustments which.

Move each journal entry to its individual account in the ledger eg Checking account Use the same debits and credits and do not change any information. How to prepare Journal Entries in Accounting. Services are performed and clients are billed for Rs.

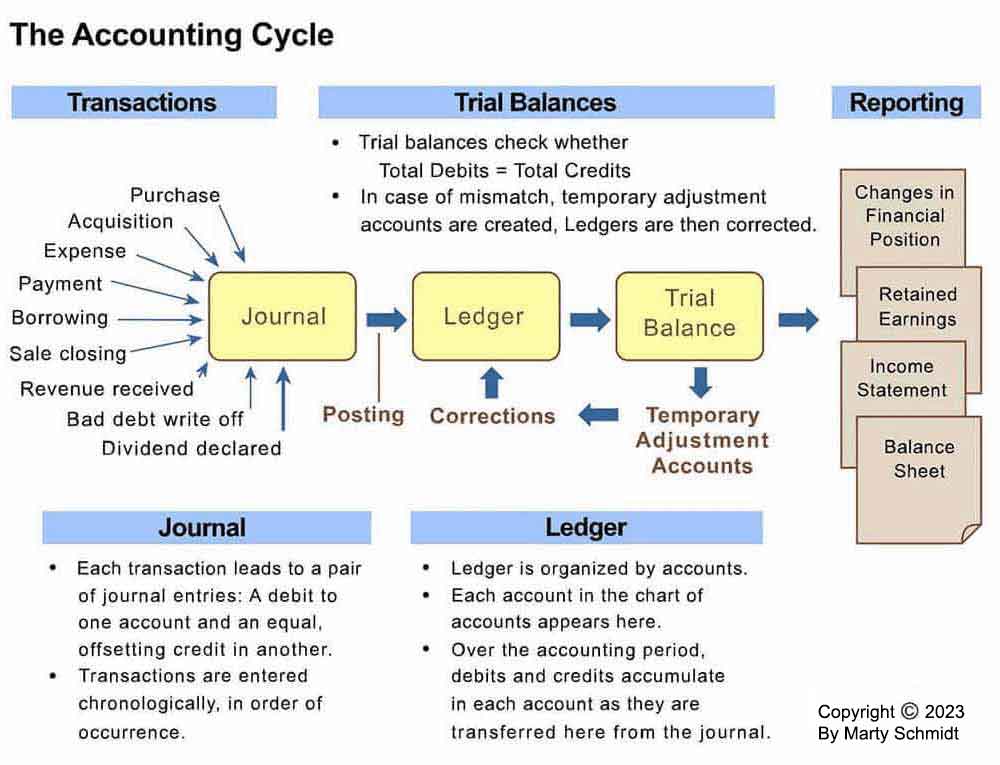

The preparation of journal entries Journalizing are very simple method which are as follows. General Journals are also called the original books of entry because this is where transactions are first logged and recorded. This chapter introduces the worksheet.

After journal entries have been posted a business owner or manager can easily find the current balance of a specific account. Prepare general journal entries for the following transactions of a business called Pose for Pics in 2016. Record in a general journal transactions that affect owners equity and receiving cash on account.

The following steps are the tab sequence for completing the form on-line. In the journal both the aspects of all the transactions are recorded by following the Double Entry. Make sure debits and credits are equal in your journal entries.

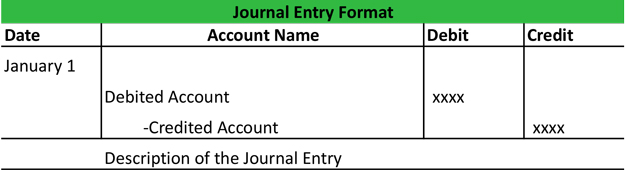

Instead follow the steps below to post journal entries to the general ledger. Hashim Khan the owner invested Rs. After identifying the accounts involved in the transaction and deciding upon the applicable rules the journal entry is recorded in the general journal in a specified format which includes the following details.

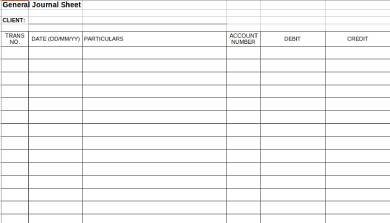

Discover learning games guided lessons and other interactive activities for children. First read and understand the transaction clearly. GENERAL JOURNAL ENTRY FORM.

After entering the journal entry write down the. How to post journal entries to the general. Start a new journal page.

General Journal is the first phase of accounting where all the transactions are recorded originally in chronological order. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Click on Accounting Date field and fill in the date.

It is in general journals that ledger accounts and t-accounts derive their entries. Discover learning games guided lessons and other interactive activities for children. If for example Maria Sanchez.

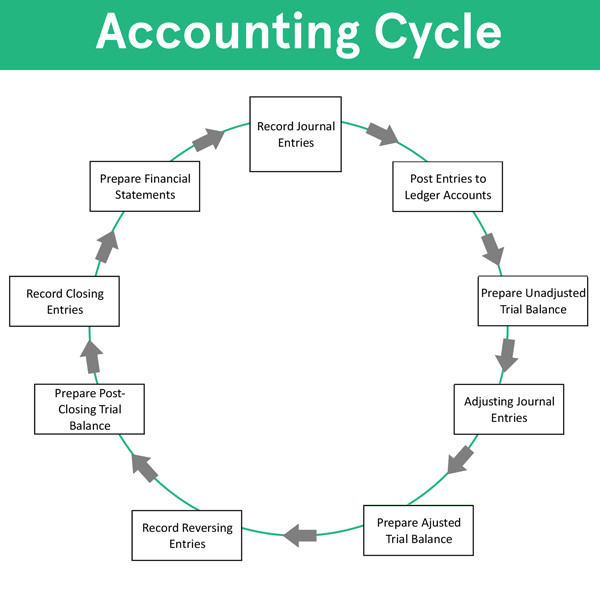

Then hit the tab key to advance to the next field. General journals are one of the basic and key components in the accounting cycle and process. Calculate account balances in your general ledger.

32500 of photography equipment in the business. This is because the general journal is the first one to receive transactions before they are transferred into. 57500 cash and Rs.

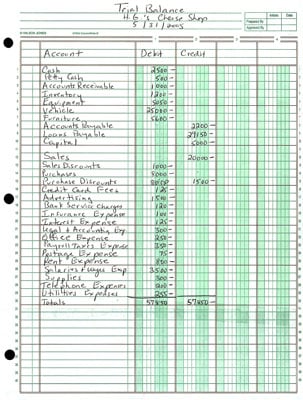

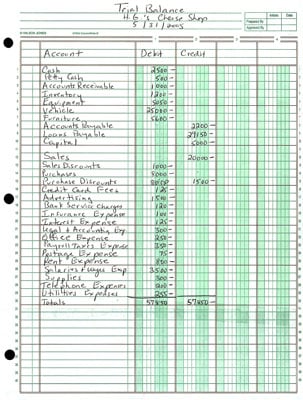

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. Recording Transactions in a General Journal 64 F Y I. Journaling and trial balancing play important roles in good accounting practices and this quiz and worksheet combination will help you test your understanding of these two key components.

General Journal Accounting. Furthermore the number of transactions entered as the debits must be equivalent to that of the credits. Posting journal entries to the ledger accounts creates a record of the impact of business transactions on each account used by a business.

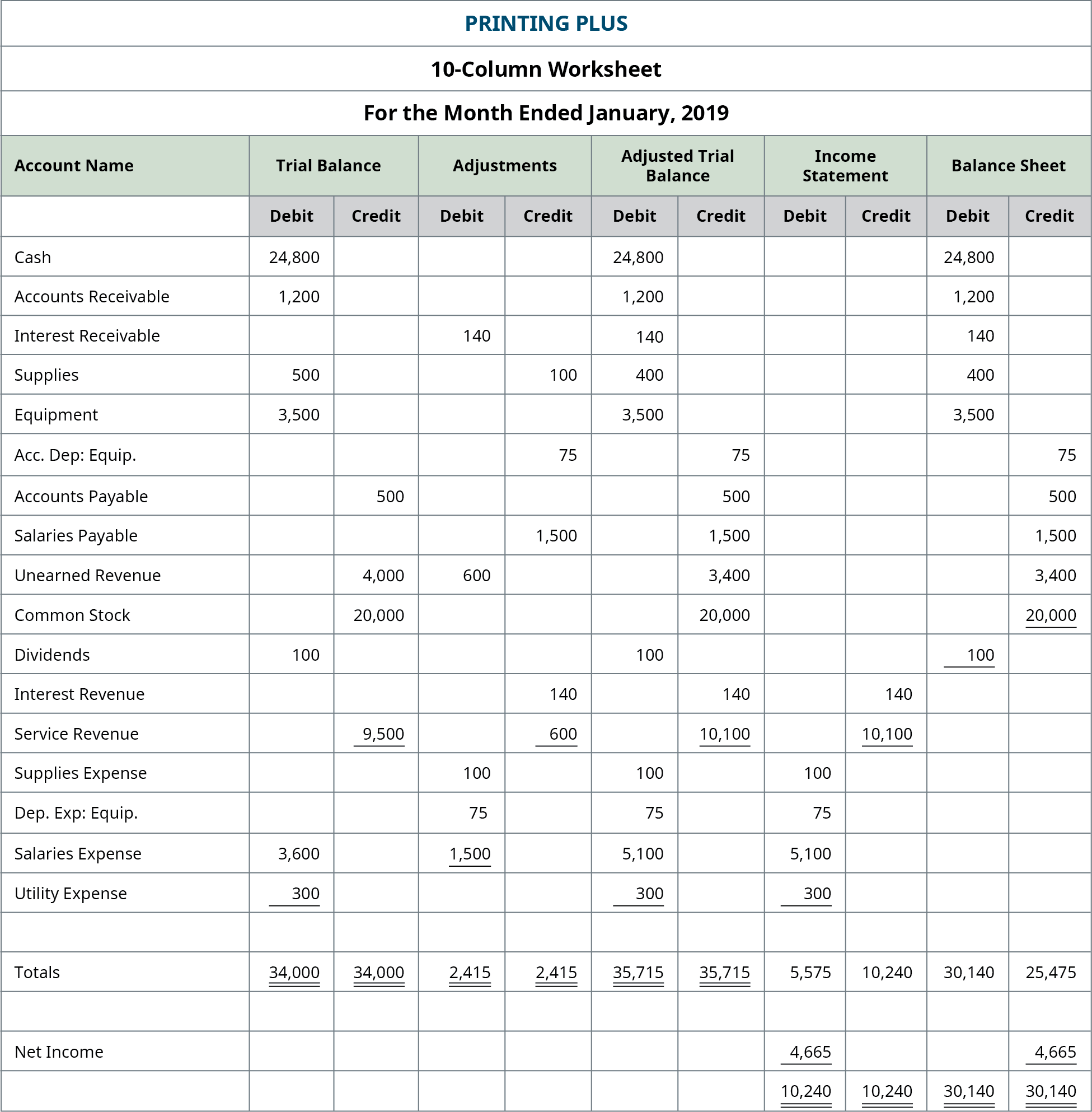

3000 cash for an insurance policy covering the next 24 months. It describes the procedures required to prepare a worksheet during the fourth step in the accounting cycle. Double entry bookkeeping Double Entry Bookkeeping Double Entry Accounting System is an accounting approach which states that each every business transaction is recorded in at least 2 accounts ie a Debit a Credit.

This is the date of the transaction NOT the date you complete the form. Find out which account is to be debited and credited and after this you can enter journal entry.

General Journal Accounting Journal Template Example

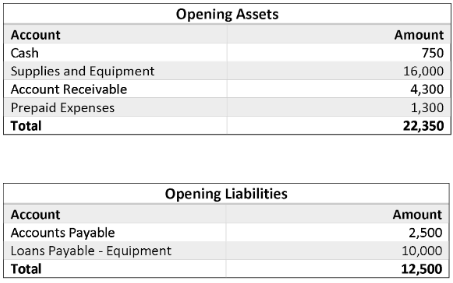

Opening Entry In Accounting Definition And Example Bookstime

General Journal In Accounting How To Prepare Journal Entries Youtube

Journal Entry Worksheet 02 C C C C C C C An Chegg Com

Free 5 General Journal Forms In Excel

Recording Accounting Transactions The Source Documents General Journal General Ledger Trial Balance Universalclass

The Accounting Cycle Personal Finance Lab

Journal Entry Worksheet 02 C C C C C C C An Chegg Com

Accounting Cycle Steps Flow Chart Example How To Use Explanation

How To Use Excel For Accounting And Bookkeeping Quickbooks

Preparing A Trial Balance For Your Business Dummies

Journal Entry Worksheet 4 Record The Entry For Chegg Com

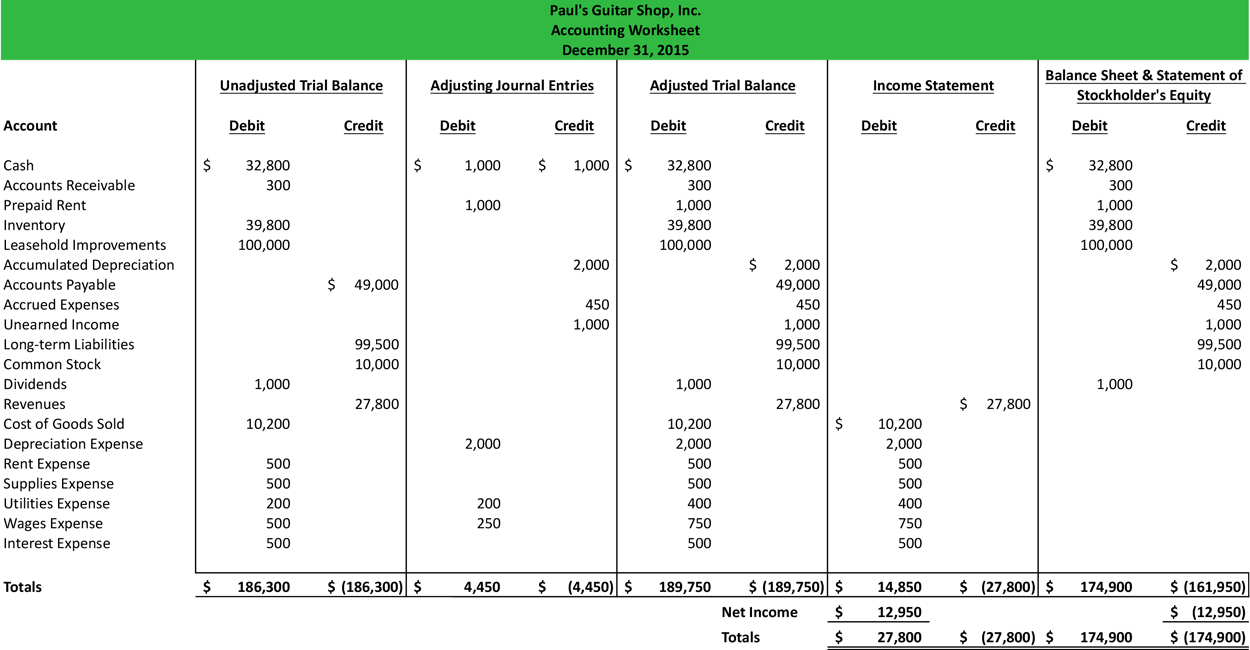

Accounting Worksheet Example Benefits Limitations Preparation

Journal Entry Worksheet 02 C C C C C C C An Chegg Com

General Journal In Accounting How To Prepare Journal Entries Youtube

Journal Daybook Entries Launch Transactions In Accounting Cycle

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting